New energy special vehicles in the first eight months: sales hit a new high!

October 14,2024

Recently, the traditional commercial vehicle market has been struggling in the "darkest moment", while the new energy special vehicle market has ushered in a "highlight moment", becoming the "red" of the current commercial vehicle market, which has attracted great attention from the industry!

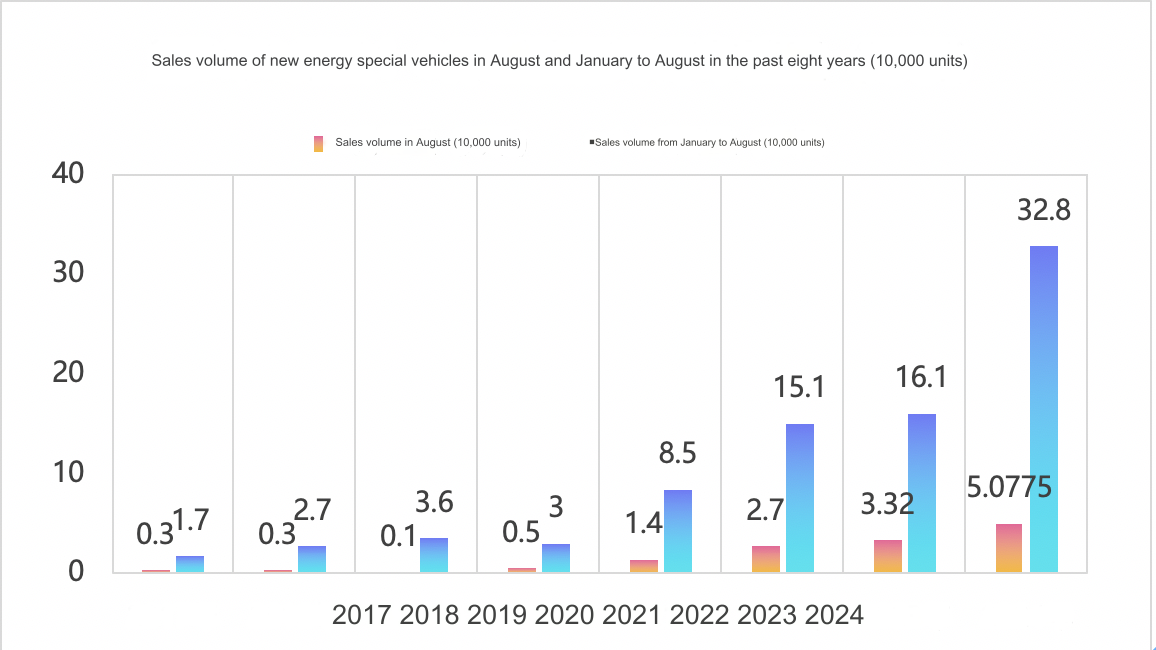

According to the terminal registration information, the sales of new energy special vehicles in August 2024 reached 50,775 units, a record high in recent years, and a year-on-year increase of nearly 50% (49.4%) (33,983 new energy special vehicles were sold in August last year); from January to August 2024, the cumulative sales of new energy special vehicles reached 328,001 units, also a record high in recent years, and nearly doubled (98%) (165,657 new energy special vehicles were sold in January to August last year), showing a strong development momentum.

So what are the main characteristics of the new energy special vehicle market in the first eight months of 2024? Now summarize and analyze.

Feature 1: Far outperforming the market, becoming the main driving force to curb the decline of the domestic commercial vehicle market

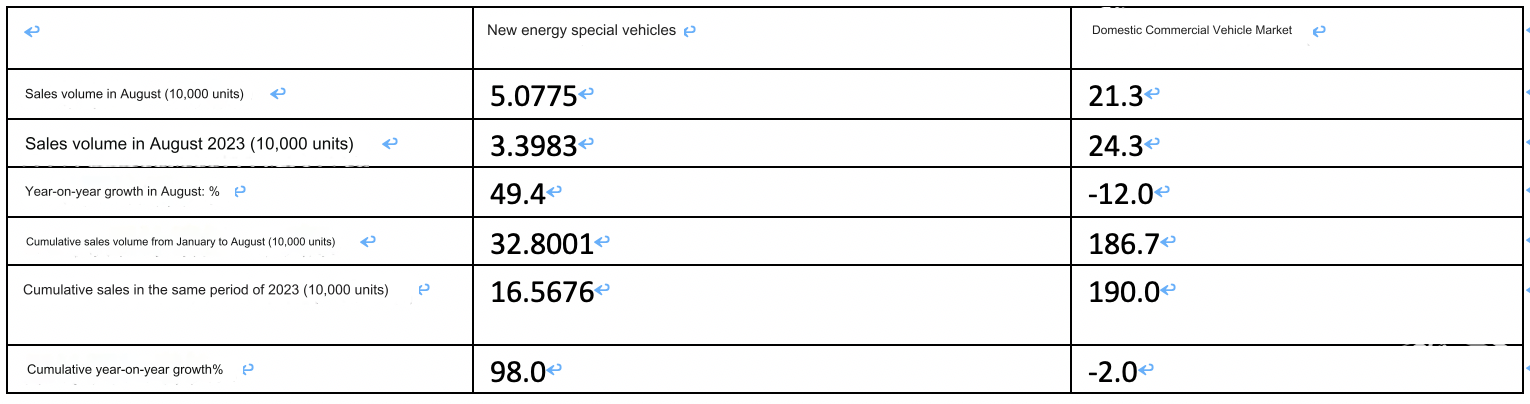

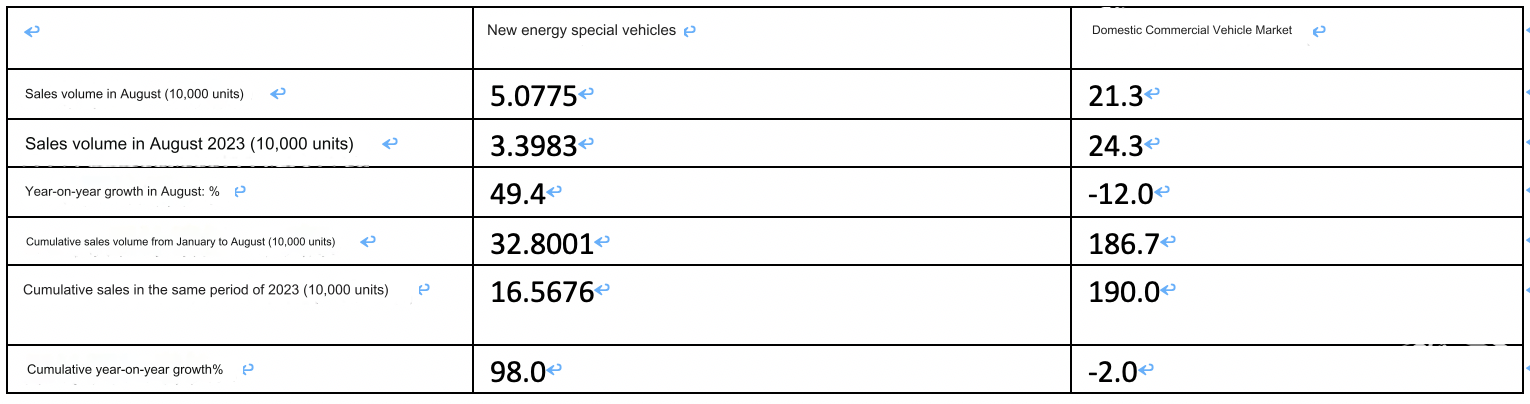

Screenshot 1, domestic commercial vehicle sales and year-on-year growth in August 2024 and January-August (data source: registration information provided by the China Automobile Dealers Association)

Table 1, based on terminal registration and screenshot 1 data, comparison of year-on-year growth rates of new energy special vehicles and domestic commercial vehicles in August 2024 and the first eight months:

The above table shows that in August 2024 and January-August, new energy special vehicles increased by 49.4% and 98% year-on-year, respectively, outperforming the domestic commercial vehicle market of -12% and -2% in August 2024 and January-August by nearly 61.4 percentage points and 100.0 percentage points, respectively.

The above table shows that in August 2024 and January-August, new energy special vehicles increased by 49.4% and 98% year-on-year, respectively, outperforming the domestic commercial vehicle market of -12% and -2% in August 2024 and January-August by nearly 61.4 percentage points and 100.0 percentage points, respectively.

In short, whether it is August this year or the first eight months, the new energy special vehicle market has far outperformed the domestic commercial vehicle market year-on-year, becoming the main driving force to curb the decline of the domestic commercial vehicle market.

According to the survey and analysis, the main reasons are as follows:

First, the continuous efforts of the national "dual carbon" strategy.

The continuous promotion of the national "dual carbon" strategy means that my country's carbon reduction goals must be gradually achieved. Commercial vehicles, as a major pollutant emission in the automotive industry, are the top priority for carbon reduction in the automotive field. Therefore, promoting the new energy of special vehicles as soon as possible is an urgent task to achieve the "dual carbon" strategic goals.

Second, the state and local governments have intensively introduced favorable policies to encourage and support the development of new energy logistics vehicles.

Since the beginning of this year, the national and local governments have intensively introduced favorable policies to encourage and support the development of new energy logistics vehicles, especially in terms of road rights, license plate registration, road use, annual inspection and other aspects, which have provided great convenience, promoting the sharp increase in the sales of new energy logistics vehicles.

Third, the further implementation of the new regulations on blue-plate light trucks has promoted the sharp increase in new energy logistics light trucks and micro trucks.

The further implementation of the new regulations on blue-plate trucks has limited the cargo capacity of traditional blue-plate light trucks, prompting some end customers to give up buying traditional light trucks and switch to new energy light trucks and micro trucks to run urban distribution business. Because new energy light trucks and micro trucks have the same road rights as blue-plate light trucks, but the cost of use is lower than that of fuel light trucks and micro trucks; at the same time, they are easier and smoother than fuel light trucks and micro trucks in terms of license plate registration, annual inspection, and road use.

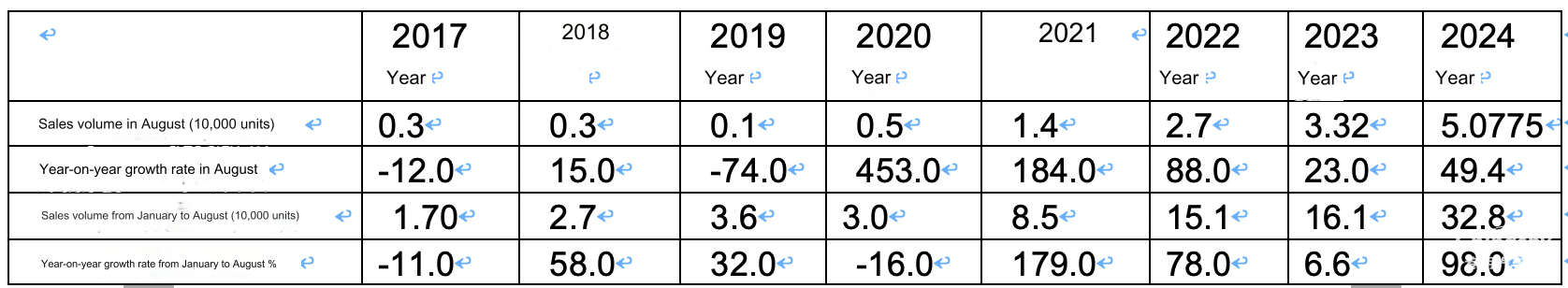

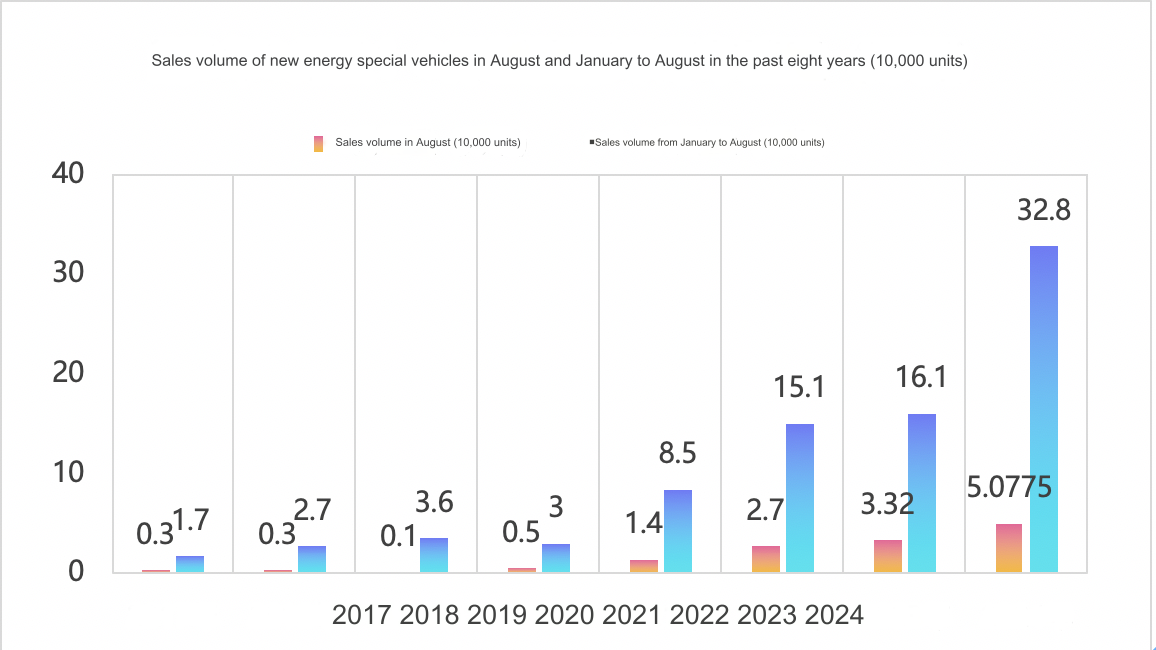

Feature 2: Sales hit a record high in the same period of the previous year

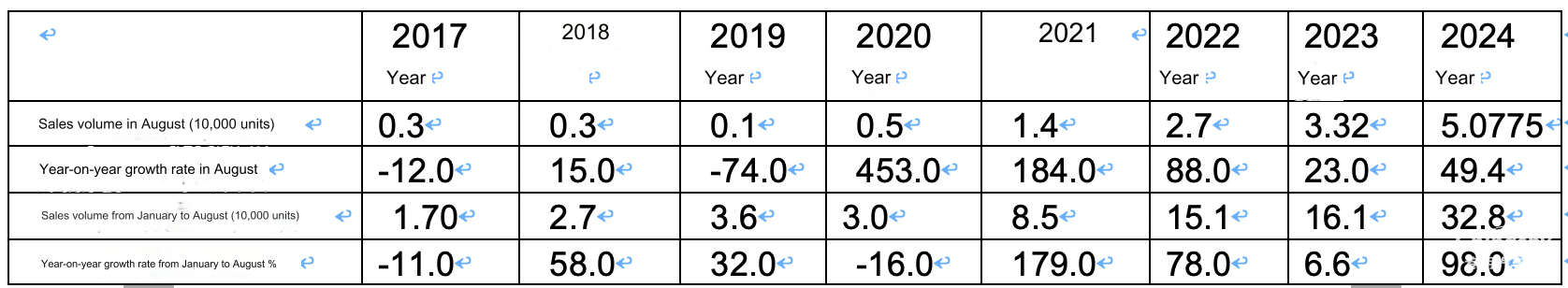

Table 2, sales and year-on-year growth rate of new energy special vehicles in August and January-August in the past 8 years (data source: terminal registration)

The above chart shows that the sales volume of new energy special vehicles in 2024 reached a record high in the same period in the past eight years, whether in August or January-August. This shows that the new energy special vehicle market in August and January-August this year is the most popular "highlight moment" in recent years. The specific reasons have been briefly analyzed above.

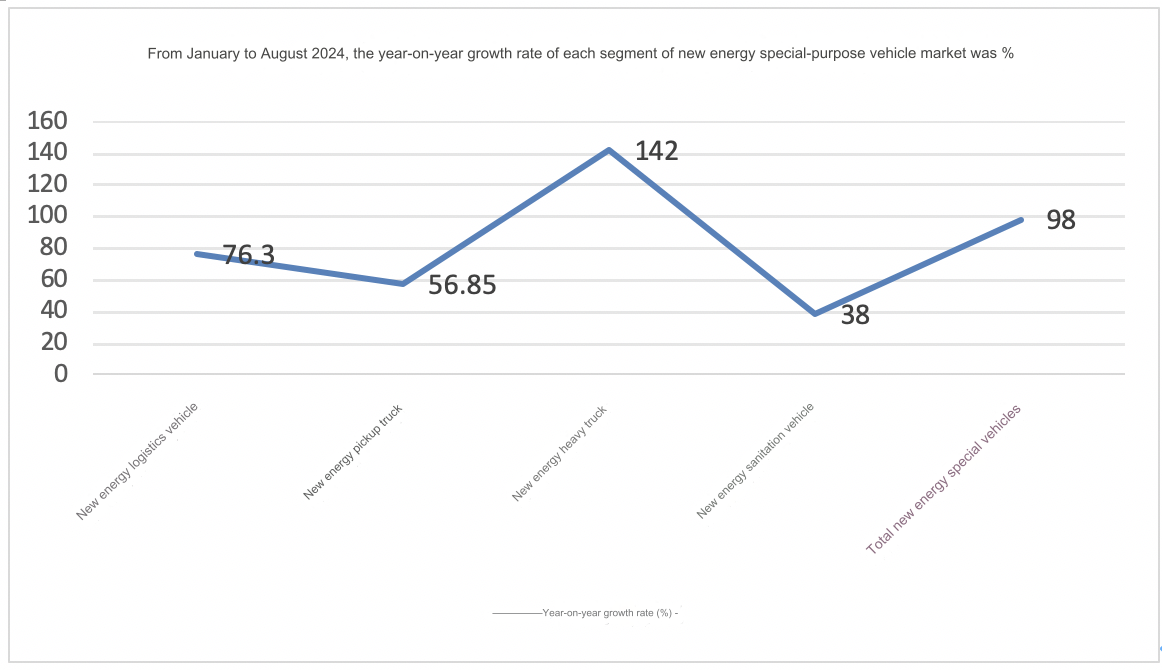

Special three: In the first eight months: new energy city distribution logistics vehicles lead the way, and new energy heavy trucks lead the rise

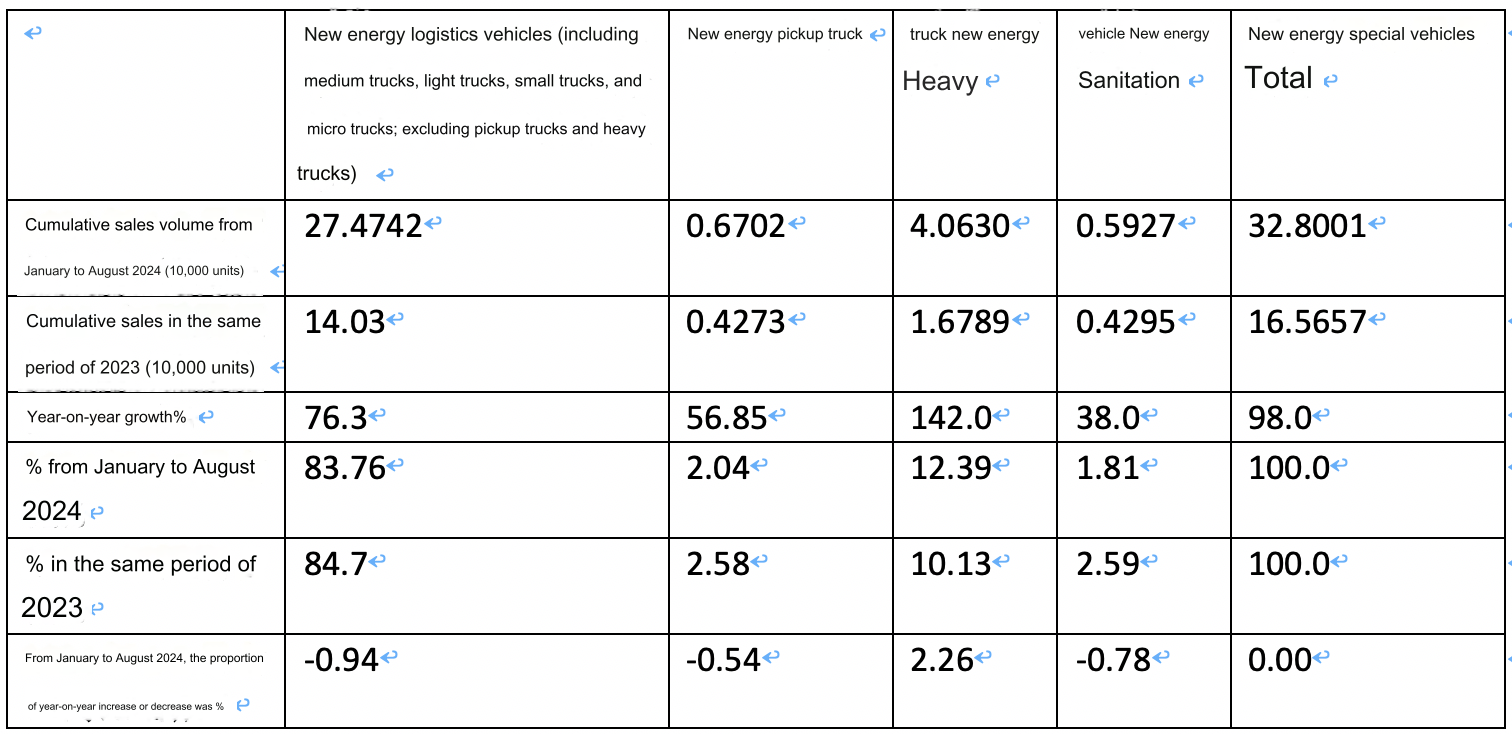

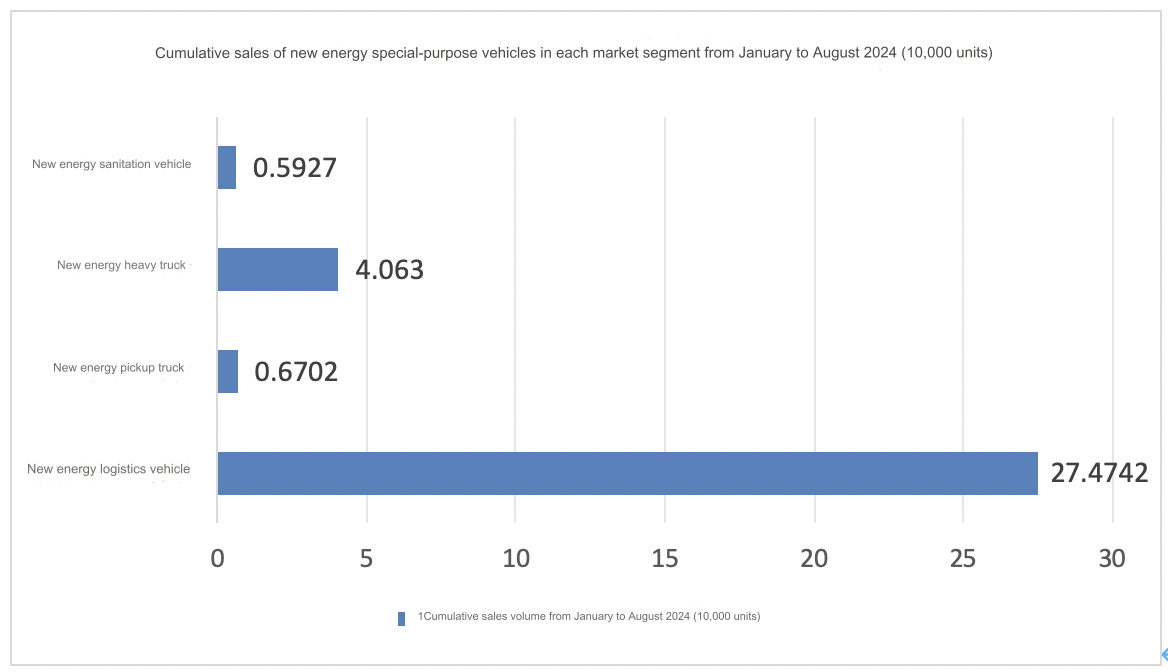

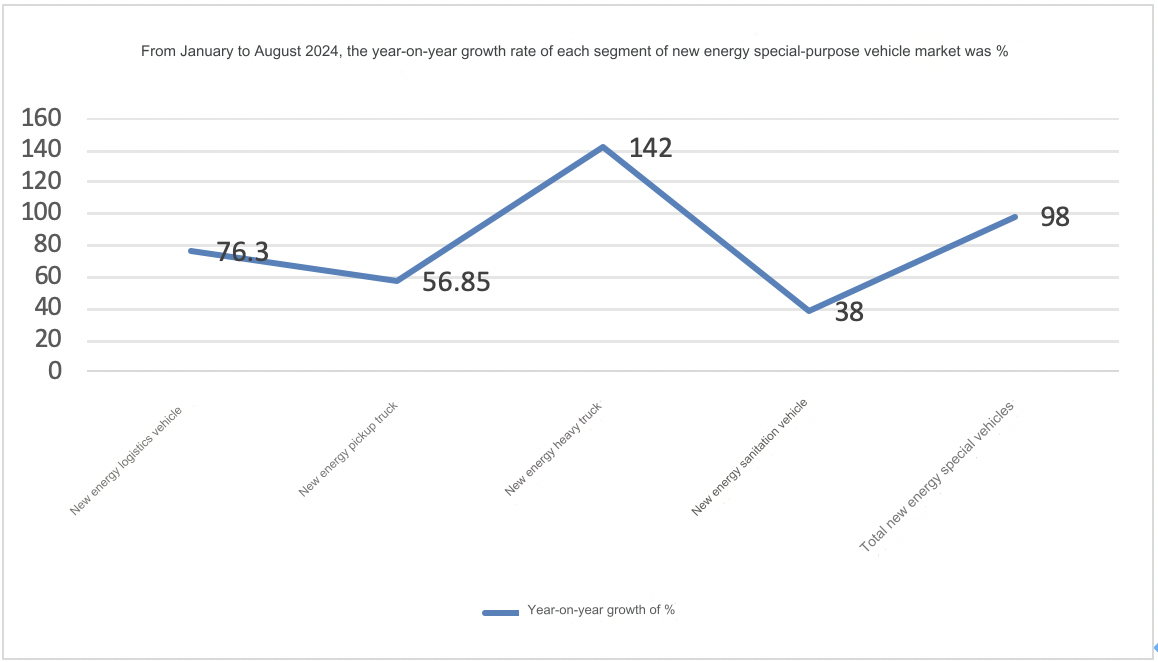

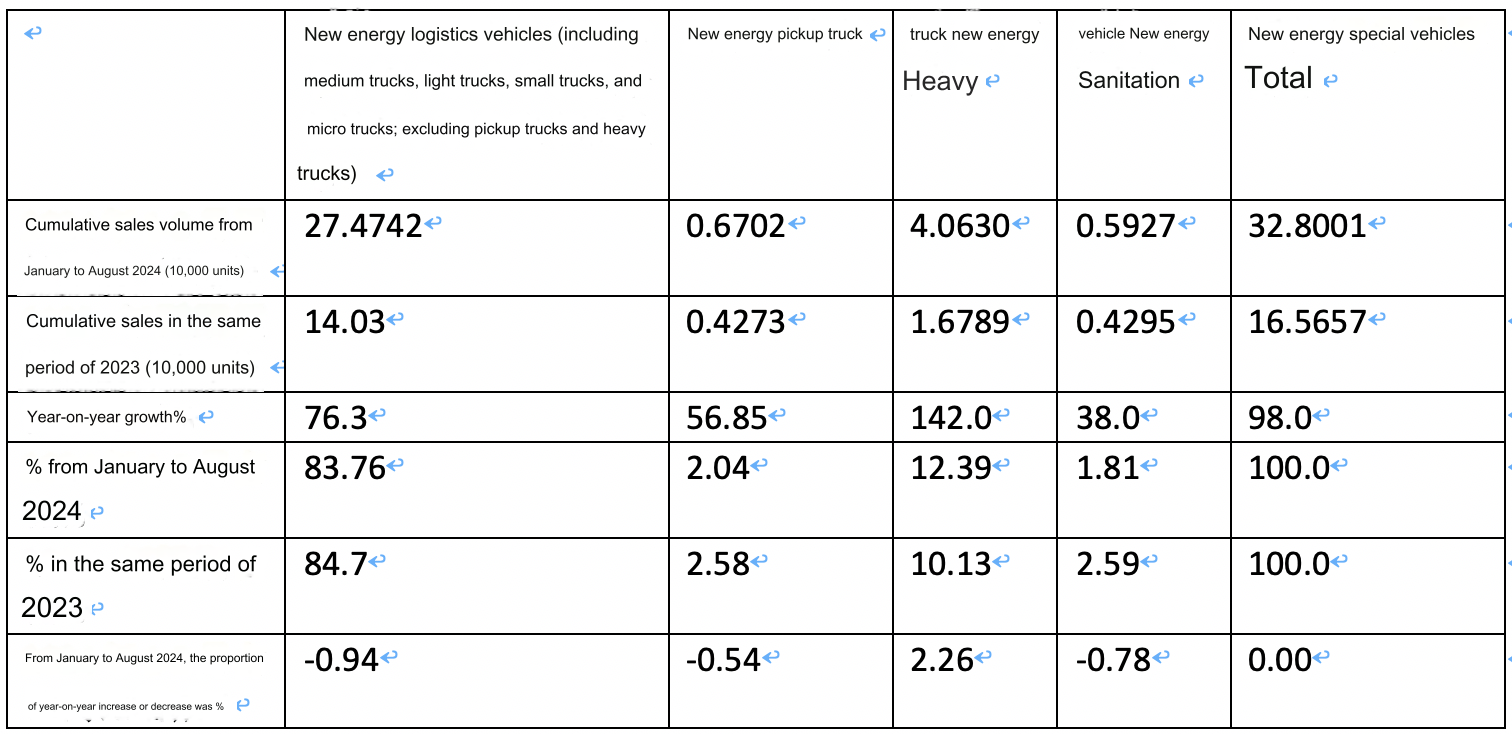

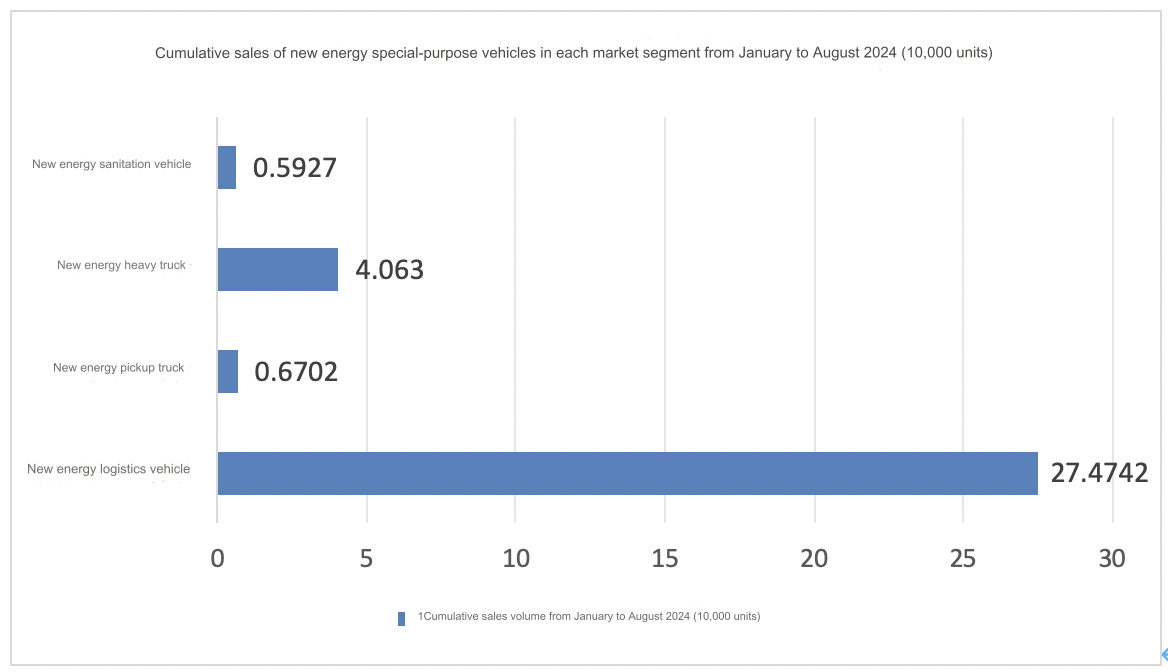

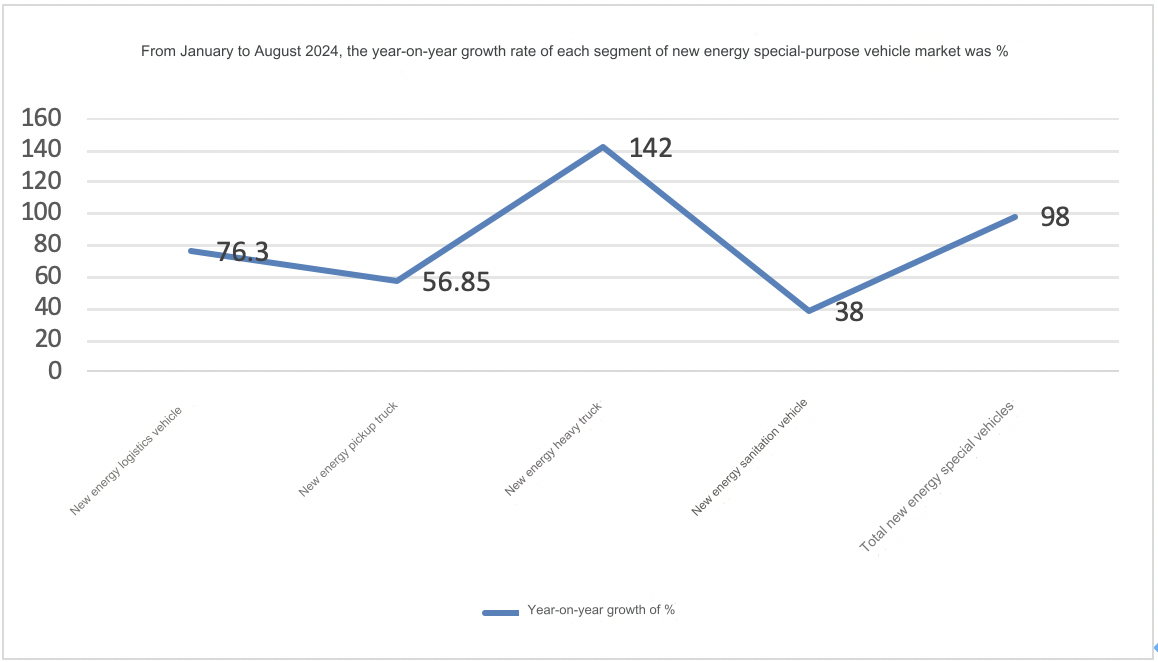

Table 3, based on electric vehicle resources and terminal registration data, divided by target market use, the sales structure of the new energy special vehicle market in the first eight months of 2024 is statistically divided:

The above chart shows that, by target market, in the new energy special vehicle market from January to August 2024:

---New energy city distribution logistics vehicles (including new energy medium trucks, light trucks, small trucks and micro trucks) have a cumulative sales of 274,742 units, a year-on-year increase of 76.3%, which is nearly 21.7 percentage points lower than the 98% increase of the new energy special vehicle market. It accounts for more than 80% (83.76%) of the weight of new energy special vehicles, and is the largest market segment in new energy special vehicles. It has become the absolute main part of the new energy special vehicle market from January to August 2024, but the proportion has decreased by 0.94 percentage points year-on-year.

---The cumulative sales of new energy heavy trucks reached 40,630, up 142% year-on-year, outperforming and leading the growth of 98% of the new energy special-purpose vehicle market by nearly 44 percentage points;

---The cumulative sales of new energy pickup trucks reached 60,720, up 56.85% year-on-year, underperforming and leading the growth of 98% of the new energy special-purpose vehicle market by 41.15 percentage points;

---The cumulative sales of new energy sanitation vehicles reached 59,270, up 38% year-on-year, underperforming and leading the growth of 98% of the new energy special-purpose vehicle market by nearly 60 percentage points.

In short, in the various segments of new energy special-purpose vehicles from January to August this year, new energy city distribution logistics vehicles led the way, and new energy heavy trucks led the way.

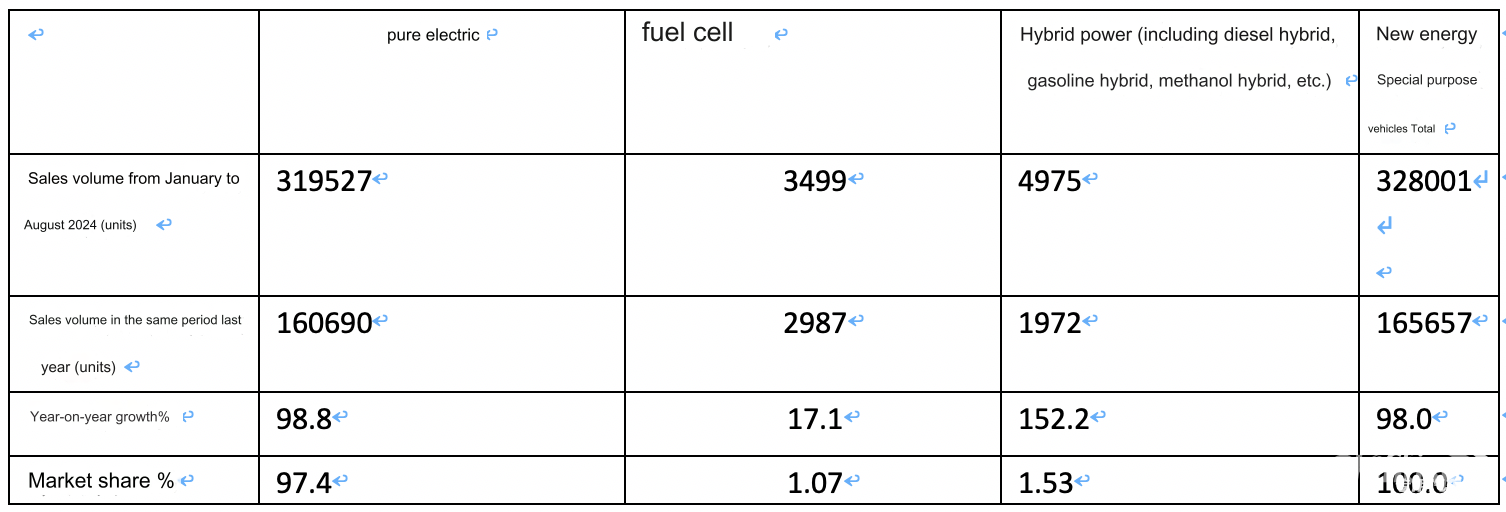

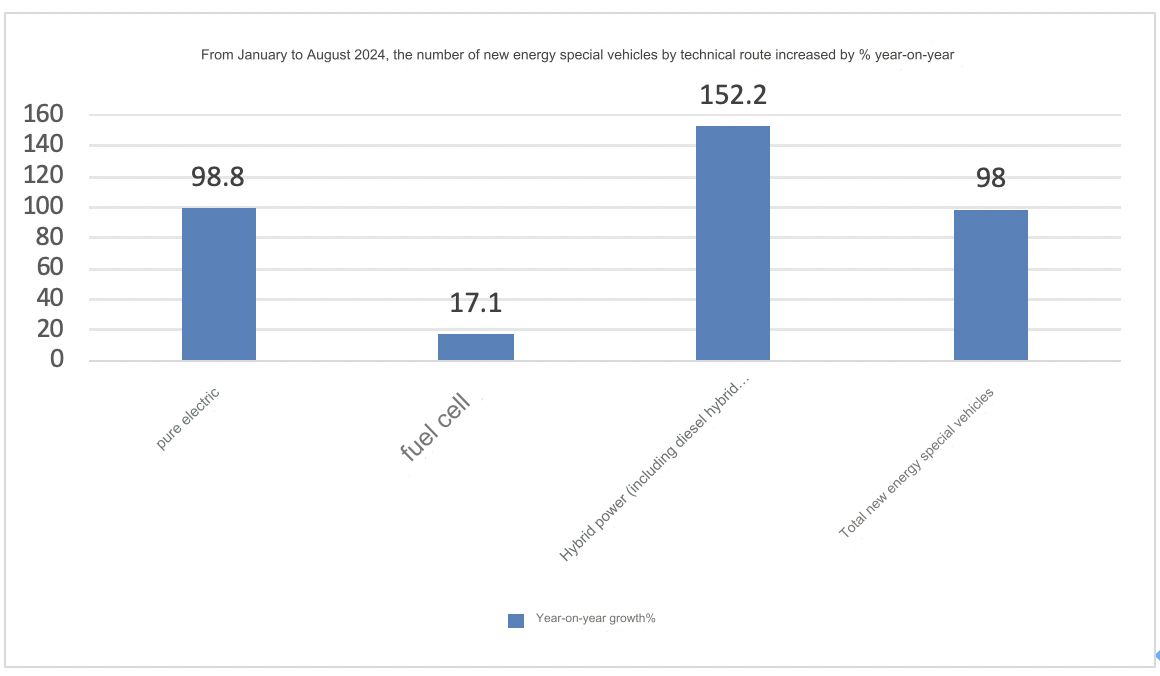

Feature 4: In the first eight months: divided by technical route, pure electric leads; hybrid leads the way

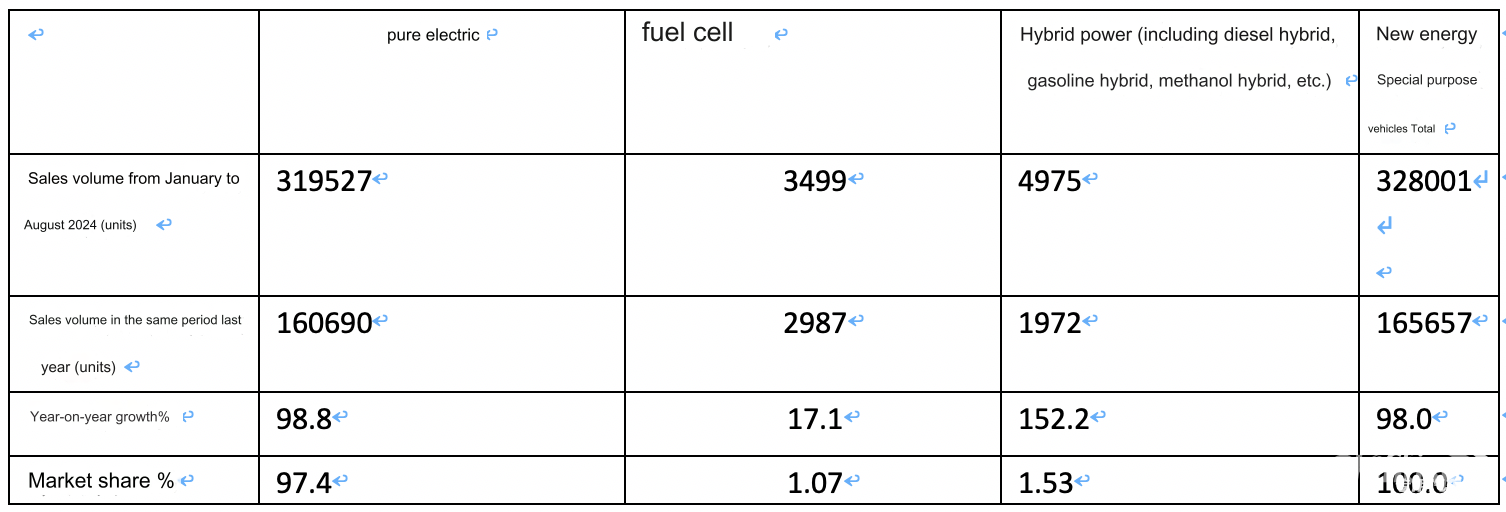

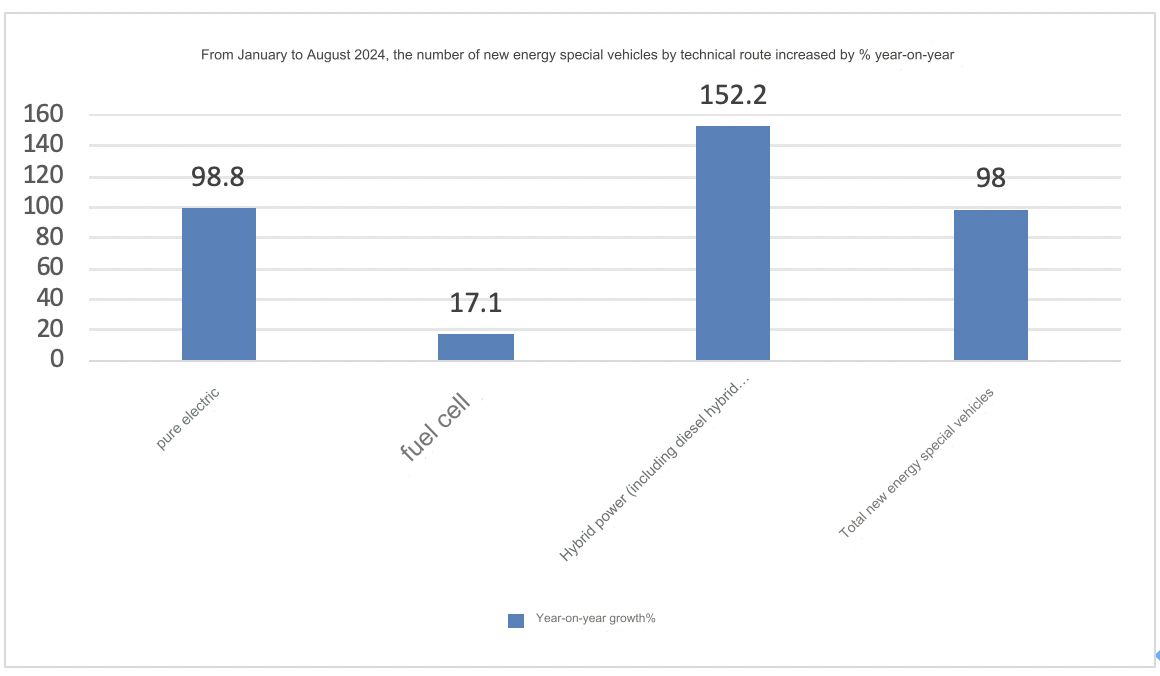

Table 4, according to terminal registration data, divided by technical route, the sales structure statistics of new energy special-purpose vehicles from January to August 2024:

The above chart shows that, by technology route, in the sales structure of new energy special vehicles from January to August 2024:

----The cumulative sales of pure electric vehicles were 319,527, a year-on-year increase of 98.8%, accounting for 97.4% of the weight of new energy special vehicles, and occupying an absolute dominant position; mainly because pure electric technology is mature, can achieve zero emissions, and can get rid of dependence on fuel, so it is widely promoted;

---The cumulative sales of fuel cell new energy special vehicles were 3,499, a year-on-year increase of 17.1%, underperforming and leading the decline of the new energy special vehicle market, with a market share of only 1.07%, ranking the smallest. According to analysis, this is mainly because the cost of fuel cells is too high and there are few hydrogen refueling stations, which are currently difficult for general customers to accept.

---The cumulative sales of hybrid special vehicles were 4,975, a year-on-year increase of 152.2%, outperforming and leading the new energy special vehicle market, with an eye-catching performance, and a market share of 1.53%. According to analysis, it is mainly due to the expansion of application scenarios of special vehicles such as new energy logistics vehicles, and some areas with imperfect charging facilities have more requirements for environmental protection and road rights, so the demand for hybrid special vehicles has increased. After all, hybrid special vehicles do not have the problem of range anxiety, and can also enjoy the "green card" road right policy.

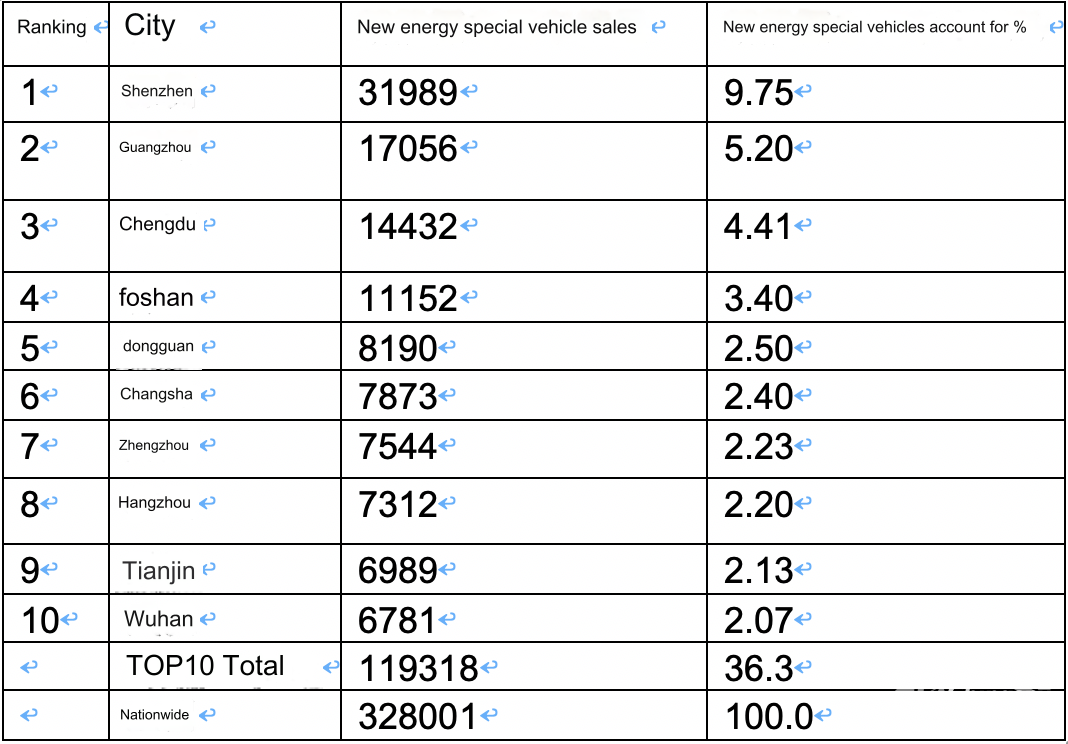

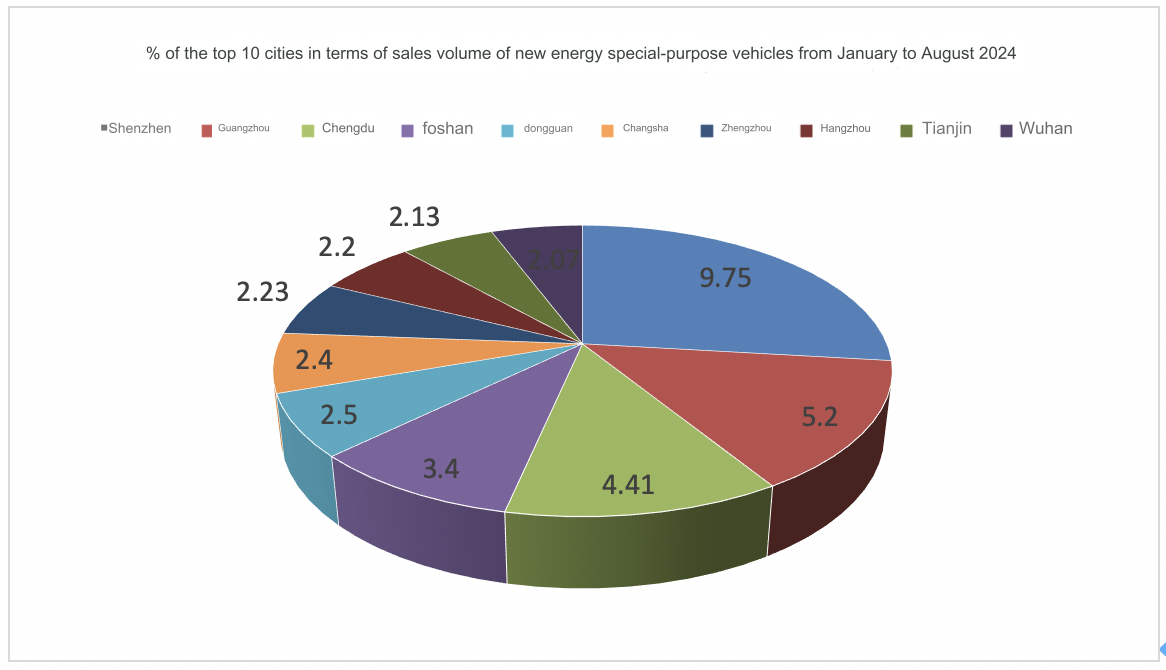

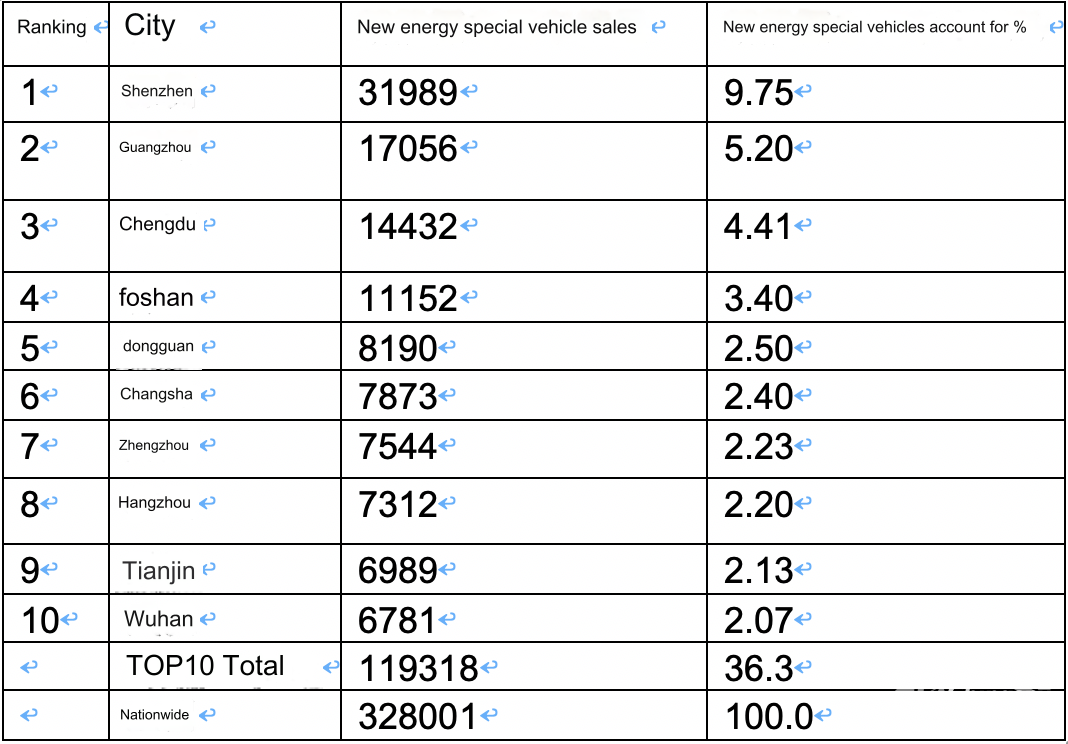

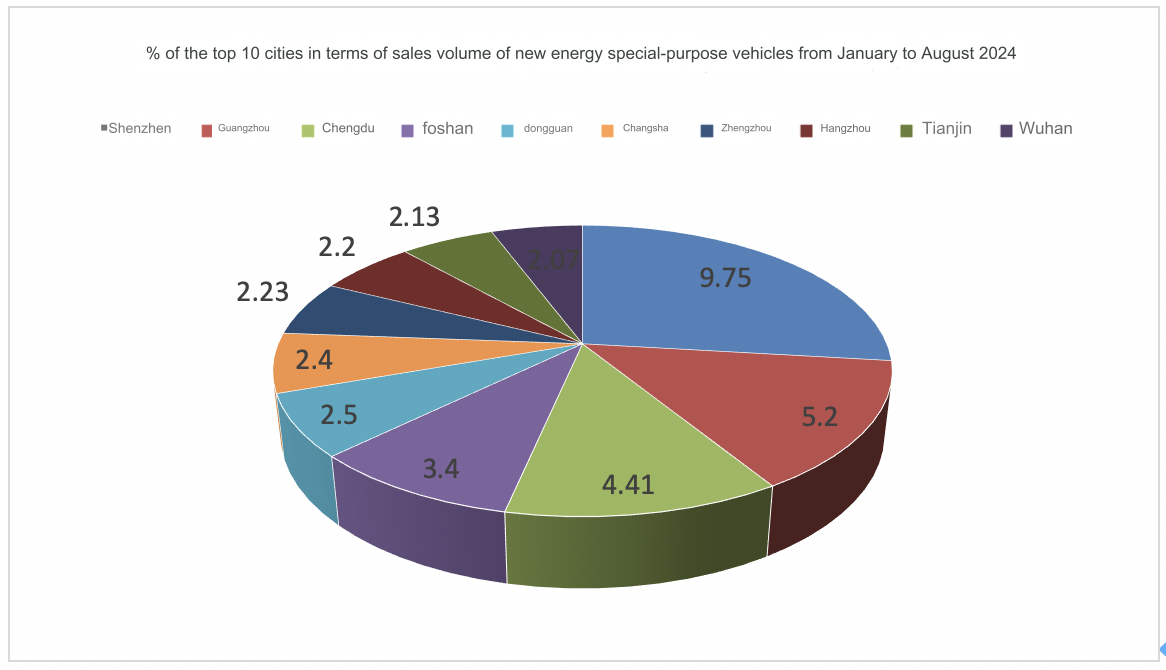

Feature 5: Regional flow in the first 8 months: Shenzhen is the only one; Guangzhou and Chengdu are ranked second and third

Table 5, according to terminal registration data, the top 10 cities with cumulative sales of domestic new energy special vehicles from January to August 2024 are:

The above chart shows that in the flow of domestic new energy special vehicles in 2024, Shenzhen, Guangzhou and Chengdu ranked the top three; there are four cities with cumulative sales exceeding 10,000 vehicles, namely Shenzhen, Guangzhou, Chengdu and Dongguan. Among them, Shenzhen is the only one with cumulative sales exceeding 30,000 vehicles.

Overall, my country's new energy special vehicle market showed a strong development momentum from January to August 2024.

According to the terminal registration information, the sales of new energy special vehicles in August 2024 reached 50,775 units, a record high in recent years, and a year-on-year increase of nearly 50% (49.4%) (33,983 new energy special vehicles were sold in August last year); from January to August 2024, the cumulative sales of new energy special vehicles reached 328,001 units, also a record high in recent years, and nearly doubled (98%) (165,657 new energy special vehicles were sold in January to August last year), showing a strong development momentum.

So what are the main characteristics of the new energy special vehicle market in the first eight months of 2024? Now summarize and analyze.

Feature 1: Far outperforming the market, becoming the main driving force to curb the decline of the domestic commercial vehicle market

Screenshot 1, domestic commercial vehicle sales and year-on-year growth in August 2024 and January-August (data source: registration information provided by the China Automobile Dealers Association)

Table 1, based on terminal registration and screenshot 1 data, comparison of year-on-year growth rates of new energy special vehicles and domestic commercial vehicles in August 2024 and the first eight months:

The above table shows that in August 2024 and January-August, new energy special vehicles increased by 49.4% and 98% year-on-year, respectively, outperforming the domestic commercial vehicle market of -12% and -2% in August 2024 and January-August by nearly 61.4 percentage points and 100.0 percentage points, respectively.

The above table shows that in August 2024 and January-August, new energy special vehicles increased by 49.4% and 98% year-on-year, respectively, outperforming the domestic commercial vehicle market of -12% and -2% in August 2024 and January-August by nearly 61.4 percentage points and 100.0 percentage points, respectively.In short, whether it is August this year or the first eight months, the new energy special vehicle market has far outperformed the domestic commercial vehicle market year-on-year, becoming the main driving force to curb the decline of the domestic commercial vehicle market.

According to the survey and analysis, the main reasons are as follows:

First, the continuous efforts of the national "dual carbon" strategy.

The continuous promotion of the national "dual carbon" strategy means that my country's carbon reduction goals must be gradually achieved. Commercial vehicles, as a major pollutant emission in the automotive industry, are the top priority for carbon reduction in the automotive field. Therefore, promoting the new energy of special vehicles as soon as possible is an urgent task to achieve the "dual carbon" strategic goals.

Second, the state and local governments have intensively introduced favorable policies to encourage and support the development of new energy logistics vehicles.

Since the beginning of this year, the national and local governments have intensively introduced favorable policies to encourage and support the development of new energy logistics vehicles, especially in terms of road rights, license plate registration, road use, annual inspection and other aspects, which have provided great convenience, promoting the sharp increase in the sales of new energy logistics vehicles.

Third, the further implementation of the new regulations on blue-plate light trucks has promoted the sharp increase in new energy logistics light trucks and micro trucks.

The further implementation of the new regulations on blue-plate trucks has limited the cargo capacity of traditional blue-plate light trucks, prompting some end customers to give up buying traditional light trucks and switch to new energy light trucks and micro trucks to run urban distribution business. Because new energy light trucks and micro trucks have the same road rights as blue-plate light trucks, but the cost of use is lower than that of fuel light trucks and micro trucks; at the same time, they are easier and smoother than fuel light trucks and micro trucks in terms of license plate registration, annual inspection, and road use.

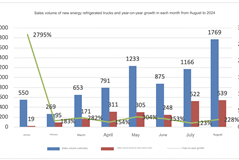

Feature 2: Sales hit a record high in the same period of the previous year

Table 2, sales and year-on-year growth rate of new energy special vehicles in August and January-August in the past 8 years (data source: terminal registration)

The above chart shows that the sales volume of new energy special vehicles in 2024 reached a record high in the same period in the past eight years, whether in August or January-August. This shows that the new energy special vehicle market in August and January-August this year is the most popular "highlight moment" in recent years. The specific reasons have been briefly analyzed above.

Special three: In the first eight months: new energy city distribution logistics vehicles lead the way, and new energy heavy trucks lead the rise

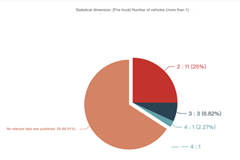

Table 3, based on electric vehicle resources and terminal registration data, divided by target market use, the sales structure of the new energy special vehicle market in the first eight months of 2024 is statistically divided:

The above chart shows that, by target market, in the new energy special vehicle market from January to August 2024:

---New energy city distribution logistics vehicles (including new energy medium trucks, light trucks, small trucks and micro trucks) have a cumulative sales of 274,742 units, a year-on-year increase of 76.3%, which is nearly 21.7 percentage points lower than the 98% increase of the new energy special vehicle market. It accounts for more than 80% (83.76%) of the weight of new energy special vehicles, and is the largest market segment in new energy special vehicles. It has become the absolute main part of the new energy special vehicle market from January to August 2024, but the proportion has decreased by 0.94 percentage points year-on-year.

---The cumulative sales of new energy heavy trucks reached 40,630, up 142% year-on-year, outperforming and leading the growth of 98% of the new energy special-purpose vehicle market by nearly 44 percentage points;

---The cumulative sales of new energy pickup trucks reached 60,720, up 56.85% year-on-year, underperforming and leading the growth of 98% of the new energy special-purpose vehicle market by 41.15 percentage points;

---The cumulative sales of new energy sanitation vehicles reached 59,270, up 38% year-on-year, underperforming and leading the growth of 98% of the new energy special-purpose vehicle market by nearly 60 percentage points.

In short, in the various segments of new energy special-purpose vehicles from January to August this year, new energy city distribution logistics vehicles led the way, and new energy heavy trucks led the way.

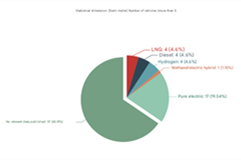

Feature 4: In the first eight months: divided by technical route, pure electric leads; hybrid leads the way

Table 4, according to terminal registration data, divided by technical route, the sales structure statistics of new energy special-purpose vehicles from January to August 2024:

The above chart shows that, by technology route, in the sales structure of new energy special vehicles from January to August 2024:

----The cumulative sales of pure electric vehicles were 319,527, a year-on-year increase of 98.8%, accounting for 97.4% of the weight of new energy special vehicles, and occupying an absolute dominant position; mainly because pure electric technology is mature, can achieve zero emissions, and can get rid of dependence on fuel, so it is widely promoted;

---The cumulative sales of fuel cell new energy special vehicles were 3,499, a year-on-year increase of 17.1%, underperforming and leading the decline of the new energy special vehicle market, with a market share of only 1.07%, ranking the smallest. According to analysis, this is mainly because the cost of fuel cells is too high and there are few hydrogen refueling stations, which are currently difficult for general customers to accept.

---The cumulative sales of hybrid special vehicles were 4,975, a year-on-year increase of 152.2%, outperforming and leading the new energy special vehicle market, with an eye-catching performance, and a market share of 1.53%. According to analysis, it is mainly due to the expansion of application scenarios of special vehicles such as new energy logistics vehicles, and some areas with imperfect charging facilities have more requirements for environmental protection and road rights, so the demand for hybrid special vehicles has increased. After all, hybrid special vehicles do not have the problem of range anxiety, and can also enjoy the "green card" road right policy.

Feature 5: Regional flow in the first 8 months: Shenzhen is the only one; Guangzhou and Chengdu are ranked second and third

Table 5, according to terminal registration data, the top 10 cities with cumulative sales of domestic new energy special vehicles from January to August 2024 are:

The above chart shows that in the flow of domestic new energy special vehicles in 2024, Shenzhen, Guangzhou and Chengdu ranked the top three; there are four cities with cumulative sales exceeding 10,000 vehicles, namely Shenzhen, Guangzhou, Chengdu and Dongguan. Among them, Shenzhen is the only one with cumulative sales exceeding 30,000 vehicles.

Overall, my country's new energy special vehicle market showed a strong development momentum from January to August 2024.

Source : www.chinaspv.com

Editor : Sissi

Views:3313

Poster

Press to save or share